Foreclosure Risk Calculator

Calculate the risk of loss at foreclosure using this simple calculator by - Alex BejanishviliAre you planning to foreclose a property or mortgage loan?

Thought of losing your house can blow you off psychologically as most of us feel emotionally attached to our house. However just like other dilemmas, you can solve your financial crisis in a rational way. If you own a distressed property that is either on foreclosure or short sales then we recommend you to thoroughly assess the risks involved. Foreclosure can be difficult on emotional side but is definitely an orderly process. In the end, you can still hope to gain some funds to carry on.

Often the financial institutions levy a penalty on borrower for paying off the mortgage loans earlier than agreed, hence it is important to know your options. Our Foreclosure Risk Calculator will help you in calculating the profit or loss that may incur to the lender with the foreclosure or short sale decision. This sheet will help you in carefully evaluating whether you will be able to reduce the amount you owe towards the debt or you need to renegotiate a short sale or refinancing option.

Foreclosure Risk Calculator

for Excel® 2003+, OpenOffice & Google DocsFile: XLS

File: XLSX

File: OTS

File: SPREADSHEET

1.0.1

Microsoft Excel® 2003 or Higher (PC & Mac)

Not Used

Not Required

Alex Bejanishvili of Spreadsheet123.com

User License Agreement

Contact Us

Using the calculator

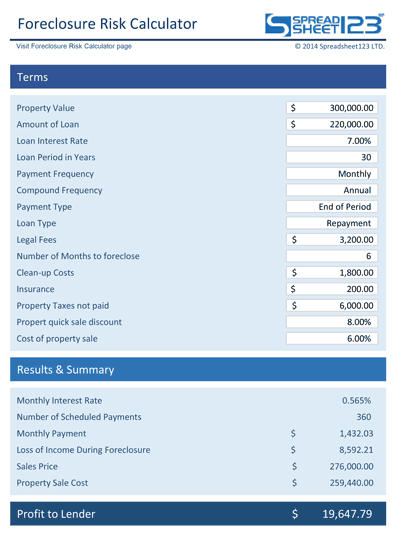

Begin by downloading this template and recording the terms of your mortgage or property loan. You will need to enter following in the Foreclosure Calculator:

- Property Value

- Amount of Loan

- Loan Interest Rate

- Loan Period in Years

- Payment Frequency

- Compound Frequency

- Payment Type

- Loan Type

- Legal Fees

- Number of Months to foreclose

You can easily get most of the information above from your loan agreement documents. Then based on current the service provider you have chosen, you can enter Clean-up Costs and Insurance amount. You will also need to record Property Taxes not paid, Property quick sale discount you might offer and estimated Cost of property sale.

Based on the values you have entered, the "Results & Summary" section will automatically calculate following:

- Monthly Interest Rate

- Number of Scheduled Payments

- Monthly Payment

- Loss of Income During Foreclosure

- Sales Price

- Property Sale Cost

In the end the Foreclosure calculator clearly states whether there will be a "Profit to Lender" or "Loss to Lender", based on whether the lender gets a positive value after deducting Amount of loan, Legal Fees, Loss of income during foreclosure, Cleanup costs, Insurance and unpaid Property taxes from Property Sale Cost.

How is Sale price calculated?

Sale Price is the estimated value on which a property can be sold without incurring loss to the property owner. Based on how much discount you offer for quick property sale or short sale and estimated property value, the Foreclosure calculator calculates the Sale Price. It is the actual selling price of the property.

How is Property Sale Cost calculated?

Property owners usually incur some costs for selling their property which includes marketing, advertising and other legal cost. The Foreclosure calculator calculates Property Sale Cost based the estimated percentage of Cost of property sale and Sales Price.

Functions used in calculator

- SUM(number1, [number2], [number3], [number4], ...)

- IF(logical_test, [value_if_true], [value_if_false])

- INDEX(array, row_num, [column_num])

- MATCH(lookup_value,lookup_array,[match_type])