Excel Payroll Calculator

Download a professional Payroll Calculator for Microsoft Excel® | Updated:UPDATE: Payroll Calculator and Payroll Calculator Pro 2024 update contain new 2024 Federal Tax Tables as well as State Tax Tables (where applicable). As of the 2023 update, all versions include the new Social Security Tax Caps. Payroll Calculator Pro and all bonus files are updated with the new reporting features for creating periodic IRS Reports and Employee Tax Summary Reports for individual employees. The free version includes a preview of these reports (without the functionality). The new Beta Payroll Calculator v2.0.3, included as one of the bonus downloads, provides a degree of automation and allows to save Paystubs as PDFs in Microsoft Excel 2010 and newer. The current version is available only with the Federal Tax Tables. Still, with time we plan to expand it further and add State-specific versions, provided there will be enough interest from the users of this spreadsheet.

Are you looking for an Excel Payroll Calculator which can help to calculate the payroll for your organization?

Our Payroll Template will help you to calculate and maintain the records of pay and deductions for each of your employees. You can keep the confidential employee register where you can record employee information like name, address, date of joining, annual salary, federal allowances, pre-tax withholdings, post-tax deductions, etc.

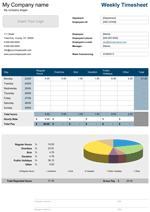

This payroll template contains several worksheets each of which are intended for performing the specific function. The first worksheet is the employee register intended for storing detailed information about each of your employees. The payroll calculator worksheet helps you with calculating the employee payroll based upon regular hours, sick leave hours, and vacation hours along with the overtime hours. The third worksheet helps to generate pay stubs for each of your employees. The fourth worksheet is the YTD payroll information, which holds the historical data that you transfer after every payroll round and the fifth worksheet includes the Federal Tax tables.

Payroll Calculator

for Excel® 2003+ & OpenOfficeFile: XLS

File: XLSX

File: OTS

2.3.1

Microsoft Excel® 2003 or Higher (PC & Mac)

Not Used

Not Required

Alex Bejanishvili of Spreadsheet123.com

User License Agreement

Contact Us

Spreadsheet123 LTD makes no representations or guarantee about the accuracy of content, fitness for a purpose or completeness of this template.

Spreadsheet123 LTD reserves the right to make changes to this software without notification.

Spreadsheet123 LTD strongly recommends to seek the advice of qualified professionals regarding making any financial or legal decisions.

Using the template

Begin by downloading the template and setting up your employee register. This template provides five set of spreadsheets to calculate the payroll of employees in your organization. The employee register is a highly confidential worksheet that stores detailed information of every employee like the personal information of each employee their salaries any other benefits that company offers them and so forth.

Once the detailed information of each employee is entered into the employee register you can now automatically calculate the payrolls using the Payroll Calculator. We need to enter the regular hours, sick hours, overtime hours and any other hours that the employee has availed. Also the template needs the rate of the overtime hour in order to calculate the payroll. The sheet has a set of pre-defined calculation formulas that calculate the Net Pay of each employee. Once the Net Pay has been calculated the Pay Stubs spreadsheet helps to generate Pay stubs of each employee these pay stubs can be sent to every employee; this helps them in understanding the breakup of the pay-out. The Pay stub shows the detailed YTD regular hours, sick hours, etc. It also shows the Gross pay and the YTD pay. The sheet also provides a graphical view of the data that helps in understanding the payroll, easily.

The YTD worksheet records a summary of payrolls dispersed to each employee from the beginning of the year till date. You can enter the information here, manually. We have kept it manual to avoid any complexity. This calculator is suitable for small and midsize companies. Then there is the Federal Tax Tables spreadsheet that provides the details of the IRS Publications that specifies the rules and rates for percentage method tables for withhold amount for an annual payroll period for single person or a married person. The Federal Tax Tables are subject to annual renewal and the links to publication are available within the template. This payroll calculator is best suited to track and calculate the payroll of every employee easily and efficiently.

Payroll Calculator Pro

Professional 2.3.2

.ZIP

Microsoft Excel® 2003 or Higher (PC & Mac)

Not Used

Not Required

via Email 24x7

Visit Support Page

- Unlocked - so that you can customize it just a little more.

- Ability to insert more rows

- Technical Support (for 90 days)

Bonus Downloads

Work Shift Schedule Pro

This is a Pro version of our Work Shift Schedule Pro template, which helps in creating a shift schedule for your employees. Besides, you can easily print a time-cards for every employee and calculate your payroll budget.

Read More

Payroll Calculator for California

This version is specially designed for calculating employee payroll tax in California. We have included California State tax table and links to official publications from where all information in the tax tables was obtained. Pay Stubs and Year to Date (YTD) were also adjusted to include all necessary information.

View Screenshot

Payroll Calculator for North Carolina

This version is specially designed for calculating employee payroll tax in North Carolina. We have included North Carolina State tax table and links to official publications from where all information in the tax tables was obtained. Pay Stubs and Year to Date (YTD) were also adjusted to include all necessary information.

View Screenshot

Payroll Calculator for Kansas

This version is specially designed for calculating employee payroll tax in Kansas. We have included Kansas State tax table and links to official publications from where all information in the tax tables was obtained. Pay Stubs and Year to Date (YTD) were also adjusted to include all necessary information.

View Screenshot

Payroll Calculator for Nebraska

This version is specially designed for calculating employee payroll tax in Nebraska. We have included Nebraska State tax table and links to official publications from where all information in the tax tables was obtained. Pay Stubs and Year to Date (YTD) were also adjusted to include all necessary information.

View Screenshot

Payroll Calculator for Kentucky

This version is specially designed for calculating employee payroll tax in the state of Kentucky. We have included the Kentucky State tax table and links to official publications from where all information was obtained. Pay Stubs and Year to Date (YTD) include all necessary information.

View Screenshot

Payroll Calculator Version 2.0.0 - Beta

The new and completely redesigned version of the Payroll Calculator offers a degree of automation (Macros Enabled Version only). The Beta release includes two files. One of the files includes a macro that adds functionality such as automatic payroll data archiving to the Year-To-Date and printing employee Earning Statements (Paystubs). Additionally, the new version provides a convenient way of creating periodic Employee Payment reports as well as IRS reports. This version is currently rolled in beta format, we welcome your feedback.

View Screenshot

Payroll Calculator for New York

This version is specially designed for calculating employee payroll tax in the state of New York. We have included the New York State tax tables as well as links to the official publications from where we obtained this information. Additionally, this version includes New York City tax tables and Yonkers tax for the residents of these cities. Pay Stubs and Year to Date (YTD) include all necessary information.

View ScreenshotHow to calculate Payroll of an employee?

The payroll calculator automatically calculates the payroll of every employee; we need to make sure that the details of each employee are complete and properly added into the spreadsheet. The details should include regular hours, holiday hours, vacation hours, sick hours, overtime hours and so forth. Also the corresponding rate for each kind of hour needs to be specified. The spreadsheet also has information about the federal tax withholdings and deductions that are to be kept in mind before calculating the payroll. Once the spreadsheet has all the desired information then it can be simply used to generate the Pay stubs. The template has an in-built calculation formula that automatically calculates the payroll for each employee.

What is the YTD Payroll?

The YTD payroll is the Year To Date earnings that records the summary of the payroll of every employee. You can manually record the complete details of pay-outs for all employee records for the current year right from the beginning of the year to the last payment that has been made. The spreadsheet also has other details like pay period, hourly breakage, pre-tax withholdings, federal, state and payroll tax and the post tax deductions.

Functions used in template

- IF(logical_test, [value_if_true], [value_if_false])

- SUM(number1, [number2], [number3], [number4], ...)

- INDEX(array,row_num,column_num)

- ISBLANK(value)

- MATCH(lookup_value, lookup_array, [match_type])

- OR(logical1,logical2,...)